As the 2026 tax filing season continues, many Americans are closely watching their bank accounts and refund status updates. For a large number of households, an IRS tax refund is not extra spending money. It is often used to manage rent, medical costs, education expenses, or debt left over from the previous year. With inflation still affecting daily expenses, refund timing matters more than ever.

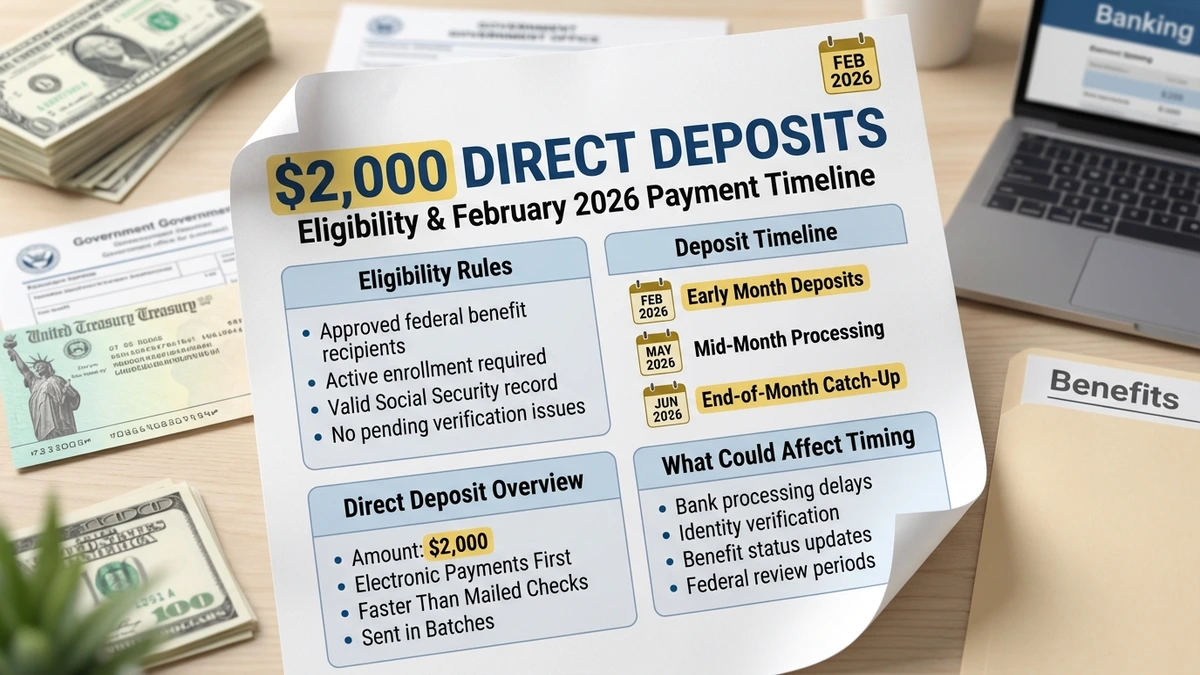

February 2026 has become a key month for expectations, especially as online conversations mention “$2,000 direct deposits.” In most cases, these deposits are not special payments but regular tax refunds. Understanding how IRS refunds actually work can help taxpayers avoid confusion and plan their finances more confidently.

Why IRS Refund Timing Is Important in 2026

Tax refunds play a steady role in household financial planning across the United States. Many taxpayers rely on this money to catch up on bills or rebuild savings after the holidays. In 2026, this dependence continues as wages and expenses remain closely matched for many families.

What makes refund timing stressful is uncertainty. The IRS does not issue refunds on one national date. Instead, refunds depend on when a return is filed, how it is processed, and whether any extra review is required. Knowing this process helps reduce anxiety and unrealistic expectations.

How the IRS Processes Tax Returns

Once a tax return is submitted, it enters a review system managed by the IRS. Electronically filed returns are processed first and move through automated checks quickly. These systems compare income data with employer records and verify credit eligibility.

If everything matches correctly, the return can be approved without delay. However, some returns are flagged for additional checks. These reviews are meant to prevent fraud and errors, not to punish taxpayers. While this process adds time, it helps ensure refunds are accurate and secure.

Why Some Refunds Take Longer Than Others

Not all tax returns are equal in complexity. Returns that include certain refundable credits often face extra review under federal law. Identity verification steps are also more common in 2026, following increased fraud attempts in recent years.

Self-employed workers, freelancers, and taxpayers with multiple income sources may experience longer waits. These delays are usually routine and not a sign of rejection. In most cases, the refund is still issued once verification is complete.

Filing Method Makes a Big Difference

How a taxpayer files their return has a strong impact on refund speed. Electronic filing remains the fastest and most reliable option. Digital returns reduce errors and enter the IRS system almost immediately after submission.

Paper returns, while still accepted, are slower due to manual processing. These returns often take several extra weeks to review. Taxpayers who want faster refunds are encouraged to file electronically whenever possible.

Choosing Direct Deposit vs Paper Checks

The way a refund is received also affects timing. Direct deposit is the quickest method and usually delivers money within days after approval. Funds are sent directly to a bank account without mailing delays.

Paper checks take longer and are affected by postal schedules. Lost or delayed mail can further slow delivery. For taxpayers expecting refunds in February 2026, direct deposit remains the safest and fastest choice.

Who Is Likely to Receive Refunds in February

Taxpayers who file early and have simple returns are most likely to see refunds by mid to late February. Early filing allows the IRS to process returns before system traffic increases later in the season.

As tax season progresses, processing times may slow due to higher volume. Filing early does not guarantee immediate payment, but it significantly improves the chances of faster refunds.

Why $2,000 Refund Amounts Get Attention

Many online discussions focus on refunds close to $2,000. This amount often appears because of common withholding patterns and standard tax credits. When over-withheld taxes are combined with credits, refunds can land near round numbers.

This does not mean the IRS is issuing a fixed $2,000 payment. Refund amounts vary based on income, tax liability, and credits. Every refund is calculated individually.

How 2026 Compares to Previous Tax Seasons

Compared to recent years, the 2026 tax season is more stable. The IRS has improved staffing and upgraded technology, helping reduce major backlogs. However, the agency remains careful due to ongoing fraud prevention efforts.

Refunds may not be dramatically faster, but they are more predictable. The biggest advantage for taxpayers is preparation. Accurate filing and early submission continue to make the biggest difference.

What Taxpayers Should Expect Going Forward

For the rest of the 2026 tax season, refund processing is expected to follow familiar patterns. Digital filing and direct deposit will remain the fastest options. Returns requiring additional review may still take longer, but most refunds will arrive within normal timeframes.

Patience and accurate information are key. Relying on official IRS tools rather than social media rumors helps reduce frustration and financial missteps.

February 2026 is an important month for many taxpayers awaiting refunds. While talk of $2,000 deposits continues online, most of these payments are standard tax refunds processed through normal IRS systems.

Understanding how refunds work allows households to plan better and avoid disappointment. Filing early, choosing direct deposit, and ensuring accurate information remain the best ways to receive refunds smoothly.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS refund amounts and timelines vary based on individual circumstances, filing accuracy, and processing conditions. Readers should consult the official IRS website or a qualified tax professional for advice specific to their situation.