As the 2026 tax filing season moves ahead, February is becoming an important month for millions of Americans waiting for their IRS tax refunds. For many households, a refund is not extra money for shopping or travel. Instead, it is often used to manage rent, medical bills, education expenses, or debt carried over from the previous year. With inflation still affecting daily costs, the arrival of refunds feels more critical than ever.

Unlike stimulus checks, tax refunds do not follow one fixed national payment date. They depend on when and how a return is filed, as well as how smoothly it moves through the IRS system. This uncertainty causes stress every year. In 2026, the IRS is following its familiar processing pattern, but with stronger checks and a continued push toward digital filing, which makes understanding the process especially important.

Why IRS Refund Timing Matters in 2026

Tax refunds play a major role in household finances across the United States. In most years, a large majority of taxpayers receive refunds, and many of those refunds fall in the range of a few thousand dollars. For low- and middle-income families, this money often goes straight toward essential needs rather than savings or leisure spending.

What matters most is not only the amount but also when the refund arrives. The IRS does not promise exact dates, but it operates within a predictable rhythm shaped by technology, staffing levels, and fraud prevention rules. Taxpayers who understand this rhythm are better prepared to plan bills and expenses without relying on rumors or online guesses.

How the IRS Processes Tax Returns

Once a tax return is submitted, it enters a review process that includes both automated and manual checks. Electronic returns are processed first because they enter the system almost instantly. IRS systems compare reported income with employer records, verify deductions, and confirm eligibility for credits. When everything matches, approval can happen fairly quickly.

Some returns take longer. Claims involving refundable credits, such as credits for low-income workers or families with children, require extra checks under federal law. Identity verification steps also remain common in 2026, following increased fraud attempts in past years. These measures help protect taxpayers but can extend waiting times for certain refunds.

Filing Method Makes a Big Difference

The way a tax return is filed still has a strong impact on refund speed. Electronic filing remains the fastest and most reliable option. Digital returns reduce errors and allow taxpayers to track progress almost immediately. In contrast, paper returns must be handled manually, which can add weeks to the processing time.

How a refund is received also matters. Direct deposit is the quickest option and usually delivers money within days after approval. Paper checks, while still available, depend on mail delivery and can face delays or complications. For anyone hoping to see a refund in February, combining e-filing with direct deposit is the most effective approach.

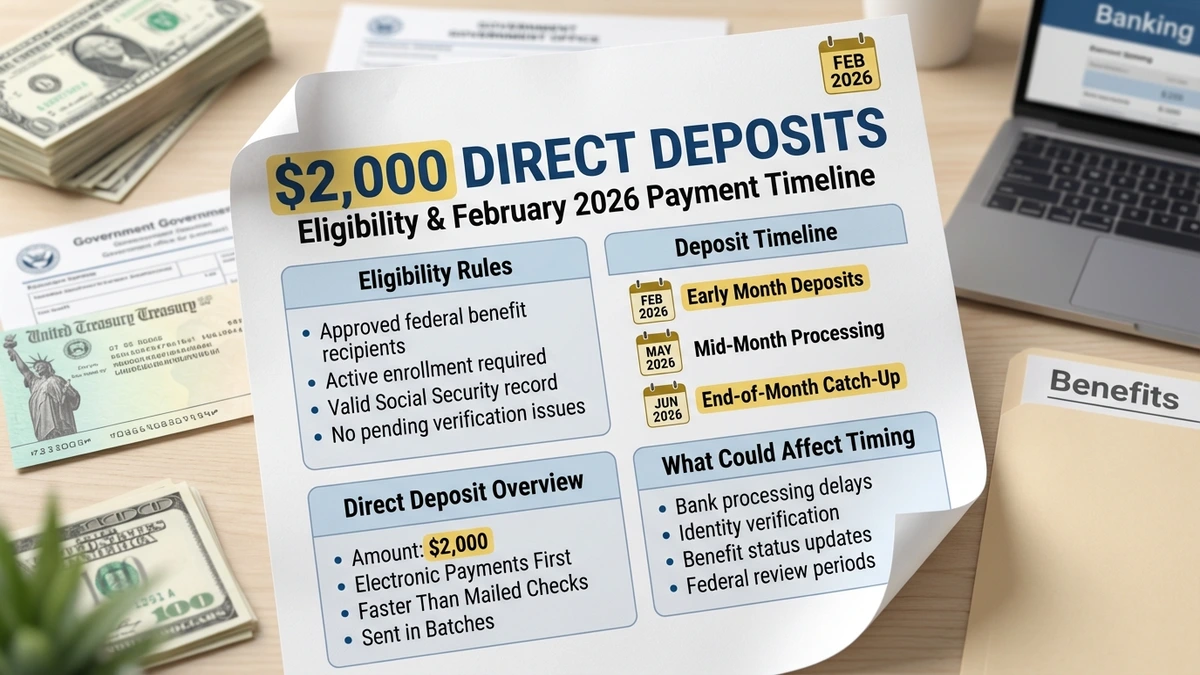

Why $2,000 Refunds Are Often Mentioned

The idea of $2,000 direct deposits often appears in conversations about February refunds, but this number is not a guaranteed amount. It comes from averages seen in past tax seasons, where many working households received refunds around this level due to withholding patterns and available credits.

Every tax situation is different. Some people receive much more, while others receive less or owe money instead. Refunds are based on income, filing status, dependents, and credits claimed. Assuming a fixed refund amount can lead to disappointment, so it is better to view $2,000 as a common example rather than a promise.

Who Receives Refunds First

Historically, early filers with simple tax situations are the first to receive refunds. Those who file in late January or early February often see deposits by mid or late February if there are no issues. As more returns arrive, processing times can slow slightly due to higher volume.

Taxpayers with more complex returns may wait longer. Freelancers, investors, or those claiming certain credits often experience additional review. These delays usually reflect careful verification rather than problems, and most refunds are eventually released once checks are completed.

How 2026 Compares to Previous Tax Seasons

Compared with the years affected by pandemic disruptions, the 2026 tax season is more stable. IRS staffing and systems have improved, reducing some backlogs. However, the agency remains cautious due to ongoing fraud risks, which means verification steps are unlikely to be relaxed.

The biggest change over time is the strong reliance on digital systems. Paper filing is now far less common and often results in the longest delays. While refunds may not arrive faster than in the past, they are more predictable for those who file electronically and accurately.

Public Expectations and Financial Impact

Each tax season brings a mix of hope and confusion. Social media often fills with claims about exact refund dates, many of which are based on personal experiences rather than official information. Financial advisors warn that relying on such claims can lead to poor budgeting decisions.

On a broader level, refund season affects the economy. Refunds often help families pay off debt, catch up on bills, or handle unexpected expenses. In 2026, refunds are likely to continue acting as a short-term financial stabilizer for households under pressure.

What Taxpayers Should Expect Next

As the 2026 tax season continues, the IRS is expected to maintain its current approach. There are no signs of major changes to processing rules, but digital filing and verification will remain priorities. Taxpayers who file early, double-check information, and choose direct deposit are most likely to see timely refunds.

While patience is sometimes required, understanding how the system works can reduce anxiety. Preparing documents early and tracking refunds through official IRS tools remains the best strategy for a smoother experience.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund amounts and timelines depend on individual tax situations, filing accuracy, and processing conditions. For the most accurate and up-to-date information, readers should consult the official IRS website or a qualified tax professional.